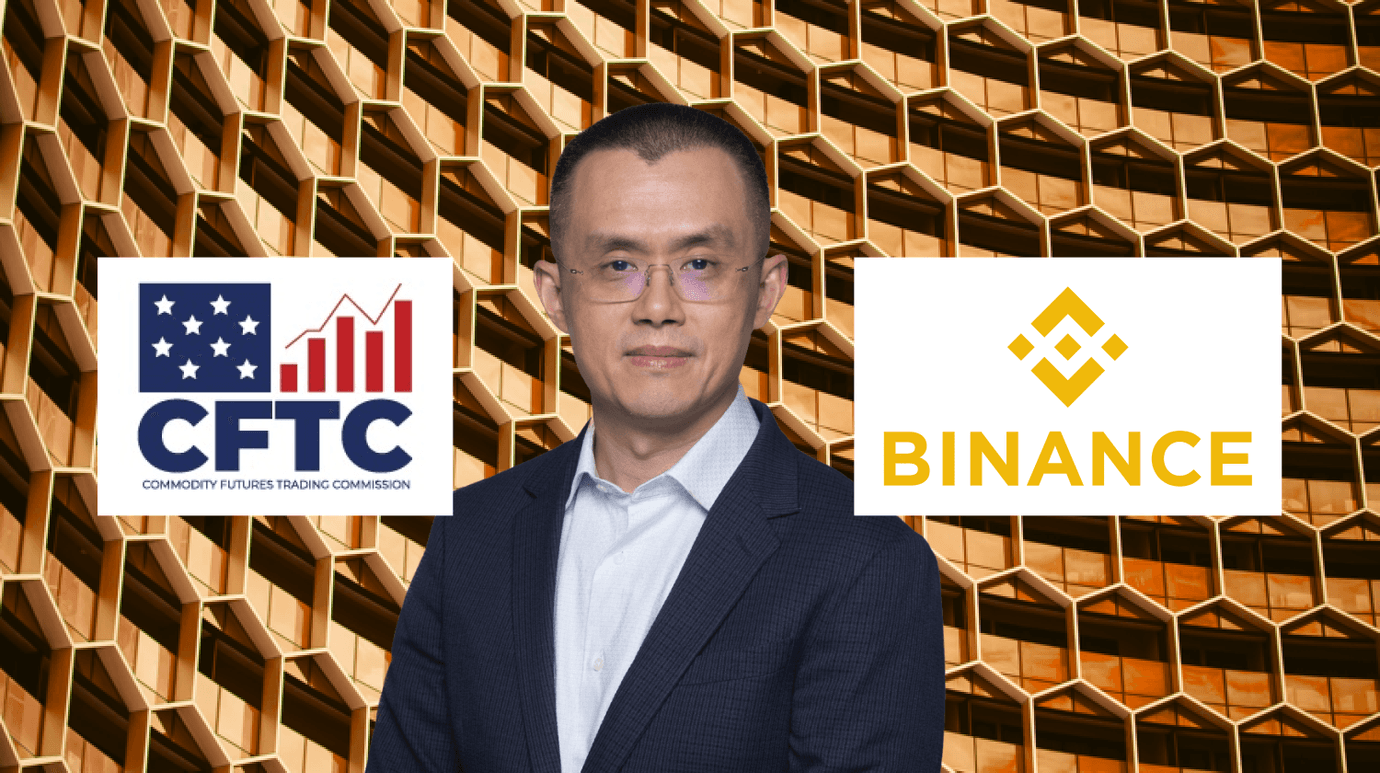

Binance vs. CFTC: The Legal Battle That Could Take Crypto Down!

Summary of recent allegations against Binance and its CEO, Changpeng Zhao, as the CFTC investigates potential regulatory violations that could reshape the crypto landscape.

The world of cryptocurrency is no stranger to controversy and legal battles. Recently, the U.S. Commodity Futures Trading Commission (CFTC) has set its sights on Binance, one of the world's leading cryptocurrency exchanges, and its CEO, Changpeng Zhao (CZ).

The case could have major implications for Binance, potentially changing the future of the company and the crypto landscape as a whole.

What’s All the FUD About?

The CFTC alleges that Binance, CZ, and other involved parties have violated numerous U.S. regulations. The case, which has long been rumored, is built on evidence that Binance ignored federal laws, catered to its U.S. customer base, and profited from these actions. The allegations also involve Binance's U.S. trading arm, Merit Peak, and BAM (Binance US).

The CFTC has gathered chat records and documents that reveal CZ's awareness of U.S. customers using Binance and his efforts to conceal this information in internal documents.

The CFTC accuses Binance of market manipulation and self-dealing, with more than 300 "house accounts" allegedly owned by CZ, Merit Peak, and Sigma chain. These accounts were reportedly used for proprietary trading without taking necessary anti-fraud or anti-manipulation precautions.

If the CFTC succeeds in their case, Binance could face severe consequences:

- Binance's U.S. operations might be permanently shut down

- The company could be banned from offering any trading services, even outside the U.S.

- CZ and other Binance employees might be prohibited from working in regulated businesses

- The company could be liable for billions of dollars in fines

- Binance Labs, the company's investment arm, could also be liquidated

Binance Response

Binance has published its response to US Senators Warren, Van Hollen, and Marshall's inquiry, emphasizing its commitment to regulation, compliance, and transparency.

The company supports a holistic approach to US regulation, has established Binance.US for American users, and has strengthened its compliance controls in collaboration with global law enforcement and regulatory bodies.

With a growing compliance team, Binance invests in policies, third-party vendors, and mandatory KYC procedures. The company ensures adherence to FATF standards and is guided by its Global Advisory Board.

Binance also maintains robust security measures, holds a one-to-one reserve of users' assets, and operates a $1 billion Secure Asset Fund for Users. Despite these efforts, Binance continues to face regulatory scrutiny in various jurisdictions, including the United States.

What's Next for Binance?

The legal battle with the CFTC will undoubtedly be a lengthy process, and the outcome is far from certain. Binance has a few options in responding to the allegations.

They could choose to fight the charges in court, leading to a drawn-out legal battle and potentially exposing more issues within the company.

Alternatively, Binance could opt for a settlement, which would still likely result in substantial financial penalties but might allow CZ and other executives to avoid admitting guilt.

The potential outcomes of the case, if found guilty, could be devastating for Binance. Refunds for all fees, salaries, earnings, and liquidations involving U.S. customers dating back to 2017, along with civil penalties, could be financially crippling for the company.

Additionally, Binance team members might never be able to legally hold another U.S. commodity or access U.S. securities again in their lifetime.

A Turning Point for the Crypto Industry?

This case against Binance, with its high-profile status and the potential for dramatic consequences, serves as a reminder of the regulatory hurdles faced by the rapidly growing cryptocurrency industry.

Regardless of the outcome, the legal battle between the CFTC and Binance will likely have a lasting impact on the sector, prompting other companies to take compliance and regulatory matters more seriously.

Final Words

The CFTC's case against Binance and its CEO, Changpeng Zhao, highlights the challenges and controversies faced by the cryptocurrency industry, particularly in terms of regulatory compliance.

Binance has responded to the inquiry from US Senators, emphasizing their commitment to regulation, transparency, and collaboration with global law enforcement and regulatory bodies. The outcome of the legal battle is uncertain, but the case will likely have long-lasting implications for the industry, prompting other companies to prioritize compliance and regulatory matters.

This case serves as a reminder that the rapidly growing cryptocurrency sector must navigate a complex regulatory landscape while striving to innovate and thrive.