Track Token Unlocks & Vesting Schedule of 200+ Cryptocurrencies with CoinBrain!

We are introducing a token unlock monitoring feature. Analyze hundreds of supply schedules in minutes and gain a unique edge in trading new projects.

CoinBrain is announcing its token unlock monitoring feature. This new functionality will be available directly in the CoinBrain Profiles of selected coins and also on the standalone page “Token Unlocks”.

Thanks to this new feature you will be able to observe in real time the changes in the circulating supply of specific tokens. Everything is available in the user-friendly environment of the CoinBrain platform. No previous experience needed!

TL;DR:

- CoinBrain's new token unlock feature allows you to monitor released tokens into the circulating supply easily.

- Token unlocks are available for free in hundreds of token profiles. This number is constantly expanding so you can look forward to more.

- Supply vesting means locking a part of the total supply and releasing it gradually into circulation. This is usually done to ensure a long-term commitment of the stakeholders.

- You can easily estimate price changes and catalysts by monitoring how tokens are released into circulation.

How it Works?

When a new crypto project is released, the founding team has several options as to how to design their tokenomics. Most projects choose to deploy a so-called “supply schedule”, meaning that the entire supply of their token is not available immediately, but rather released over time.

This is done usually to ensure that stakeholders of that project (developers, founders, etc.) do not dump a big chunk of the entire supply on the market, therefore greatly diluting the price.

Tokens that are promised to the stakeholders, but are not yet available are locked or held in custody for a certain amount of time. CoinBrain can now help you track how many tokens are locked, how many are circulating, and how will the supply be distributed in the future.

To analyze the token unlocking schedule you essentially have two possibilities:

Visit the “Explore” section on the CoinBrain homepage and choose the Token Unlocks tab - This will show you a list of all available tokens, which you can compare and customize.

Or! Find a specific token that you want to analyze. Open its CoinBrain profile and again choose the “Token Unlocks” tab.

Under the Token Unlock section inside token profiles, you will find a variety of information connected to its vesting.

The vesting info board includes:

1. Interactive chart - Illustrates the circulating supply change over time.

2. Allocation Groups - Represent the individual stakeholder groups and their respective percentage of total supply. You can also find a progress bar with each allocation group, as well as the dates of release events.

3. Key Vesting info - Basic information about the particular vesting, such as start and end date, amount of vesting tokens and so on.

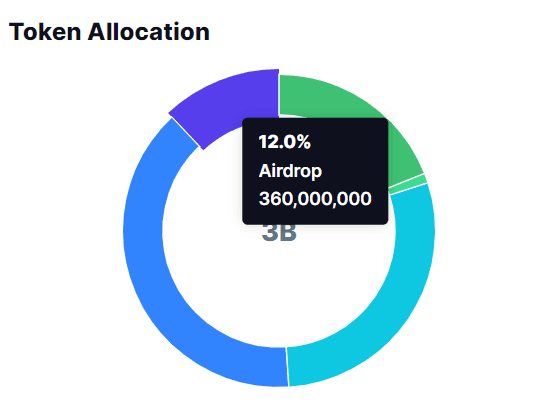

4. Token Allocation - Pie chart representing the allocation and stake of different groups.

Why is Token Vesting Important?

So, why track these vesting schedules? The important benefit is that you get to see when tokens are going to be released, which can clue you in on potential shifts in the market. It's a handy tool whether you’re investing for the long term or looking to make swift, informed trades.

For the long-term investors out there, getting the lowdown on a project’s vesting schedule is like a window into the team’s commitment. If they’re holding onto their tokens for a while, it usually signals they’re in it for the long haul. And for you, that's a sign of a stable and promising investment.

And hey, if you're more about quick trades, this feature is your new best friend. By tracking when a bunch of tokens are set to enter the market, you can better anticipate and navigate those market waves.

Using Token Unlocks Feature for Price Estimates

You may be asking yourself how exactly the token unlock schedule influences the price. It is all quite simple since we are building on the fact that scarce things tend to have higher prices than their abundant counterparts.

The more tokens you see unlocked into the circulating supply, the bigger demand you need to sustain the price. If the demand is not sufficient, then the price per token will decrease.

It is usually safe to say that with more tokens in the circulating supply, the price decreases.

With this simple rule, you can effectively guess the specific time when the price of a token is going to drop. Of course, you should take this with a grain of salt, because as you already know, price change is the result of a very complex interplay between nearly uncountable variables, so you should not depend solely on the token unlock schedule.

However, monitoring supply unlocks may serve you as a supporting tool either for long-term price development or short-term catalyst estimation.