Don't Get Rug Pulled: How to Spot a Scam in DeFi

Learn how to spot rug pulls and exit scams in the DeFi world. Avoid fraud and keep your investments safe with our guide on common signs to watch out for.

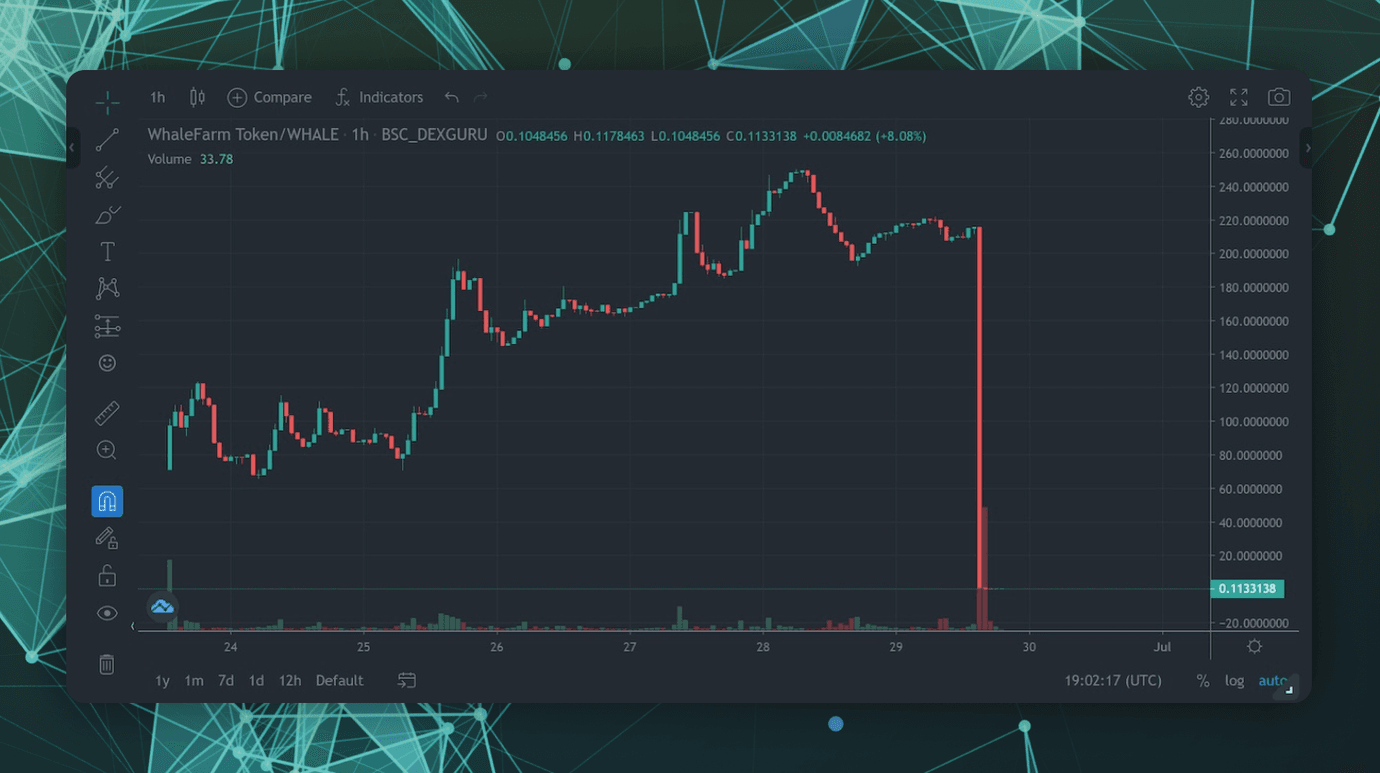

The DeFi pool may be filled with potential, but watch out for sneaky rug pulls that can leave you high and dry. In this article, we'll arm you with the tools to spot a rug pull before it's too late and keep your investments swimming with the sharks instead of becoming shark bait.

From the developers who seed initial liquidity then pump and dump, to the websites that shut down after attracting thousands of deposits, we'll show you how to confidently navigate the DeFi landscape.

Don't let your hard-earned money become a statistic in the 99% of significant fraud and misappropriations that arise from DeFi rug pulls and exit scams. Join us as we share our own rug pull experiences and guide you to safer DeFi waters. Here are the common signs of rug pulls:

Suspicious Smart Contract

An unverified smart contract code is like a mysterious package left on your doorstep. Without checking what's inside, you have no idea if it's something valuable or a ticking time bomb. By verifying the code, you can open the package, inspect its contents, and ensure it's safe to use. Alternatively, you can check, if the smart contracts have been audited by a trusted security company.

Without verification, anyone could tamper with the package and use it to steal your precious assets, just like a bad actor could execute malicious code and transfer funds from your smart contract without your knowledge.

Rushed Out Projects

Imagine building a house from scratch. It takes time, effort, and attention to detail to create a solid foundation and ensure everything is up to code. Now imagine someone trying to pass off a rickety shack as a luxurious mansion. Sure, they may have slapped on a fresh coat of paint and made a few cosmetic changes, but the shoddy construction and unfinished work are obvious signs that something is amiss.

This analogy applies to the world of cryptocurrency as well. Legitimate projects take time to plan and execute, while rushed, copycat projects are like those shaky shacks. They may look similar to the real deal on the surface, but upon closer inspection, the lack of originality, unfinished work, and even outright plagiarism, are glaring red flags.

Fake social media activity

Automated bots can mimic human behaviour by liking, retweeting, commenting, and sharing posts on a large scale, and even participating in airdrop campaigns. The fake accounts can be easily recognizable, as they often have little activity other than promoting certain posts or protocols. This kind of activity can be easily spotted by checking the follower base of the coin profile page at CoinBrain.

When evaluating a DeFi protocol, it's essential to check its social media accounts on platforms such as Twitter, Telegram, and Discord through CoinBrain. Take a close look at the users and participants, and ask yourself if they appear to be legitimate. It's always better to be safe than sorry and double-check the authenticity of social media accounts.

Untrustworthy Audits

Smart contract audits are like health check-ups for your code. Reputable firms such as Certik, Hacken, ConsenSys Diligence, Runtime Verification, Certora or Slowmist, have the experience to thoroughly examine your code and provide a report of their findings.

However, no audit is foolproof and it's essential to work with reputable auditors and make the report publicly available. Be cautious of less reputable auditors who may compromise on the quality of their work. Some projects may choose to hire multiple auditors for added security. Using a third-party review platform like DeFi Safety can also give you an in-depth analysis of multiple factors.

Lack of Timelocks and Multi-sigs

Timelocks and multi-sigs are safety features in smart contracts that protect user funds. A timelock is a code that delays changes to the smart contract for a set amount of time, giving users a chance to react and withdraw their funds.

A multi-sig, on the other hand, requires multiple signatures to authorize changes, adding an extra layer of security. Without these measures in place, a malicious admin can compromise the entire protocol instantly.

Final Words

The DeFi pool may be filled with potential, but it's important to watch out for sneaky rug pulls that can leave you high and dry. By staying vigilant and being aware of the common signs of rug pulls, such as fake social media activity or suspicious audits, you can navigate the DeFi landscape with confidence.

So, don't be a statistic in the 99% of significant fraud and misappropriations that arise from DeFi rug pulls and exit scams, and join us in exploring the DeFi world safely!