How to Spot Crappy Tokenomics in Crypto Projects

Want to avoid investing in a crypto project with weak tokenomics? Check out our guide to recognizing signs of poor tokenomics and make informed investment decisions.

For early investors and speculators bad tokenomics can be a major red flag. When deciding which project has the most potential, it is very important to have a look at how the tokenomics of the project is set. With a bit of critical thinking and some information about how tokenomics work, anyone can distinguish between a gem and a scam. We will have a look at where to find the right information as well as what to look for.

TL;DR

- Tokenomics is the study of how tokens are created, distributed, and utilized

- Best to look for sources directly from the project team - docs, whitepaper, website, etc.

- Analytic platforms, such as CoinBrain can help you with independent security checks

- The indicators of bad tokenomics include too large total supply or a high emission rate (inflationary)

- Look for clear utility in the tokens

- Pay attention If the majority of the supply is dedicated to the founding team and early investors

Quick tokenomics refresher

We strongly recommend checking out our overall Tokenomics post in the dictionary section if you haven't done so already, as it contains some valuable info on the theoretical side.

Tokenomics is the study of the economics and financial policies of a cryptocurrency or token. It helps us understand how a token is created, distributed, and managed, and how it interacts with the rest of the ecosystem. By examining the underlying mechanisms of a token, we can gain valuable insights into the way it functions and its role in the broader system.

Tokenomic design relies on principles such as Total supply, Burning and Minting, Emission rate, and Token distribution.

Examining the tokenomics of a project

The first key piece of knowledge is to know where to look in order to find out about the tokenomics of a specific project. Not all projects, especially the smaller or young ones, have all the information clearly written in one place, so you will have to dig a bit.

Starting point is usually the website of the project. Some sites have a specific section about tokenomics, where you can find the supply size, allocation, types of issued tokens, and so forth. This would be the easier case, however, you will more likely have to find the documents page.

A documents site is usually a standalone webpage with several distinct sections. Each section contains information about a certain part of the project. Look for the tokenomics section. Once you find one, it should have a detailed description of the project tokenomics, often in more technical terms.

If the project doesn't have a docs page, it is best to go directly for the project's Whitepaper. A whitepaper is a comprehensive document that outlines the details of a cryptocurrency or blockchain project, including its technology, goals, and team. Again, you will most likely come in contact with technical terms and financial lingo, so really do make sure that you understand the terms correctly.

You can use the CoinBrain Dictionary section for easy-to-understand explanations of many topics, as it may help you better analyze further projects.

What are the red flags?

When analyzing Tokenomics there are a few distinctive markers that you should look out for. It may be a good idea to create a checklist with these important markers and go one by one to determine if the tokenomic is valuable.

Unnecessarily Large Total Supply

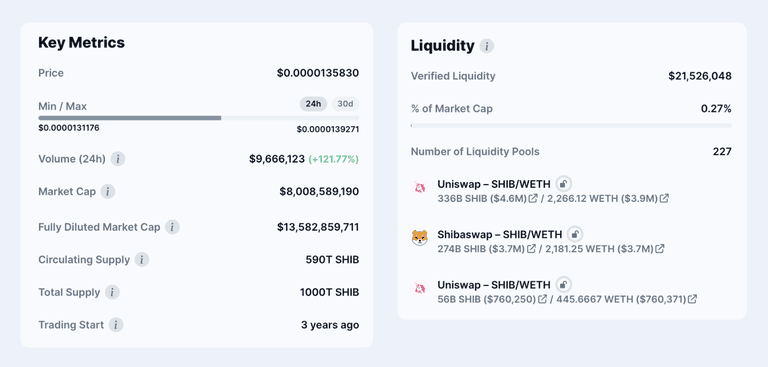

If the project has a total number of tokens in a number so high you haven't even heard of, it should grab your attention. This practice is common in tokens designed (meme tokens and/or scams) just for price manipulation with low or no additional utility.

The huge total supply translates into often an extremely low price per token. We can see examples of tokens with a price so low that it basically approaches zero. The low price also carries a psychological aspect with speculators tending to buy more than they otherwise would just because the price creates a false sense of opportunity and upside potential.

You can easily avoid bad investment decisions by checking the key metrics of a token on CoinBrain. On the main page simply click on the token you want to examine.

No clear utility

No clear utility

Another important point to consider is the utility of the tokens. The majority of tokens in the market right now have a very limited utility, causing their price to be just a product of speculation. Examine closely the documents of the project, whether any utility is mentioned - the use case should be clearly defined.

This speculative price is not necessarily a bad thing, as it can be used in various other ways, but be aware that no underlying utility makes the token basically worthless and therefore very risky investment.

Inflationary tokenomics

If we wanted inflation, we could have stayed in traditional fiat finance. Inflationary tokenomics is typical with a continuous increase in the circulating supply. This increase dilutes market capitalization and therefore gradually decreases the price per token. Inflation can be slowed by some deflationary mechanisms, such as burning. But, in order to maintain its price, the burned amount has to be higher than the minted amount at all times.

Tokens like this usually have unlimited token supplies, so they can always mint new tokens to add to the circulation. New tokens are often used as an incentive mechanism to reward holders, granting it a bit of a Ponzi-like principle.

Uneven token distribution

The token distribution tells us, how the total supply is divided among users, founding team, early investors, and so on. It plays quite an important role when evaluating tokenomics because it shows the founding team's attitude toward the project

Below is an example of ETH token distribution in a pie chart. You should focus mainly on how much of the supply is dedicated to the founding team and investors. When this part exceeds a certain percentage, for example, 40 - 50 %, it should hint to you that intentions with the project are not of a long-term nature.

Many times projects with the majority of token supply owned by founders and early investors follow a simple pump-and-dump scheme, with the end users, unfortunately, being dumped on.

For a convenient security check you can use the CoinBrain Holders analytics tool. Each token page contains information about holder distribution - creators, whales, and other significant holders.

Closing

In conclusion, understanding tokenomics is essential to making informed decisions when investing in cryptocurrency. By evaluating a project's token utility, distribution plan, supply and demand, liquidity, and complexity, you can determine whether its tokenomics are strong or weak.

Additionally, reviewing a project's Whitepaper can provide valuable insights into the technology, goals, and team behind the project. Remember to always do your own research before investing in any crypto project, and don't be afraid to ask questions or seek expert advice. With a better understanding of tokenomics and a critical eye, you can avoid scams and find promising investments that could yield significant returns in the long run.